E-filing of income tax return in five steps

Tax & Auditing

401 week ago — 3 min read

The last date to file income tax returns for the financial year 2016-17 is July 31st. Though there is some time left before the deadline, it is wise to file your tax returns well within time so that there is no last minute glitch that derails the process. Here are five steps that can streamline the e-filing of your tax returns.

Step 1 - Registration

You will have to register on the government’s portal created for the purpose of filing tax returns.. You will need your PAN number, birth date and name and then you will be asked to choose your password. Following that you will have access to the system. The PAN ID will be your username.

Step 2 - Choose your method of e-filing and pick the right form

There are two ways of e-filing. The first is by filling up an online form. The second way is to download the form to your computer, fill in the details offline and upload the form again on to the system.

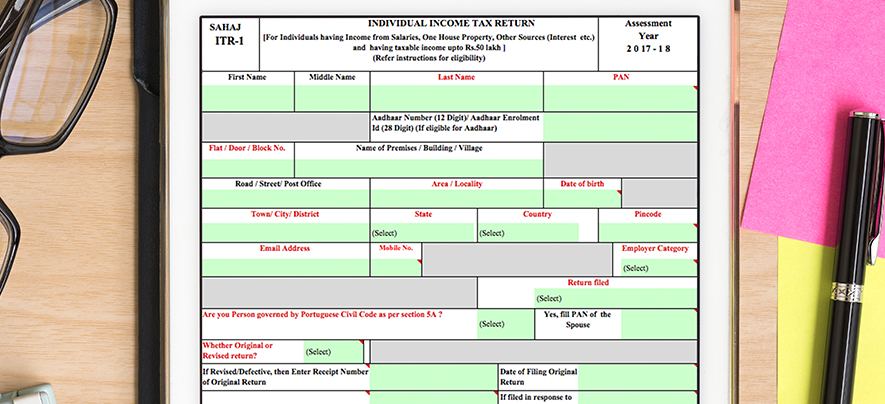

You will have to make sure you pick the correct form for submission as the information that is required is different depending on your occupation and circumstances.

- ITR-1: This is for people who draw a salary, pension, or income from property.

- ITR-2: For those earning capital gains.

- ITR 2A: for those without capital gains who are in possession of more than one house.

- ITR 3, 4 and 4S: For business owners and professionals.

Step 3 - Be prepared with documentation

Be ready with all the required documents - PAN, interest statements, Form 16, interest certificates, investment information and insurance information. You should download Form 26AS and validate your tax return.

Caveat: If you earn more than INR 50 lakh per annum you have to disclose your assets and liabilities to the government while filing your taxes. One should be meticulous in this disclosure.

Step 4 - Generating XML file if form filled offline

If the form is filled online, you will have to create an XML file before it can be uploaded to the portal. Your PAN ID is your username and you would have chosen your password.

Step 5 - Verifying your ITR-V

Once you have filed your income tax return a number will be generated called the acknowledgement number. If your filing included a digital signature, then all you need to do is preserve this number.

If you haven’t submitted a digital signature an ITR-V is sent to your e-mail. This document needs to be verified. Electronic verification is a possibility. Or sending the ITR-V to the centre in Bengaluru. This would have to be done within 120 days of filing of the return.

So the process of filing taxes is now much simpler. But it is still wise to be cautious and meticulous. Work on it ahead of time and ensure that you sail smoothly across this annual exercise.

Reference: https://incometaxindiaefiling.gov.in/

Posted by

GlobalLinker StaffWe are a team of experienced industry professionals committed to sharing our knowledge and skills with small & medium enterprises.

View GlobalLinker 's profile

Most read this week

Comments

Share this content

Please login or Register to join the discussion