How to start an export business

Export Sector

Federation of Indian Export Organisations

267 week ago — 12 min read

Export/Import Trade in India is regulated by the Directorate General of Foreign Trade (DGFT) and its regional offices. However, in the export/import trade, transaction in foreign exchange is involved and such transactions are governed by Foreign Exchange Management Act, 1999 under which Foreign Exchange Management (export of goods and services) Regulations, 2000 were framed. These regulations have been notified vide Notification No. FEMA 23/2000-RB dated May 3, 2000 as amended from time to time.

Other facets having bearing on credit such as facilitation of exports through Establishment of Branch Office/Liaison office, Formation of Joint Venture, Wholly-owned Subsidiary, Exports to Warehouse, Merchanting Trade, Cross Border online transactions are also regulated by the RBI.

Export in itself is a very wide concept and a lot of preparation is required by an exporter before starting an export business.

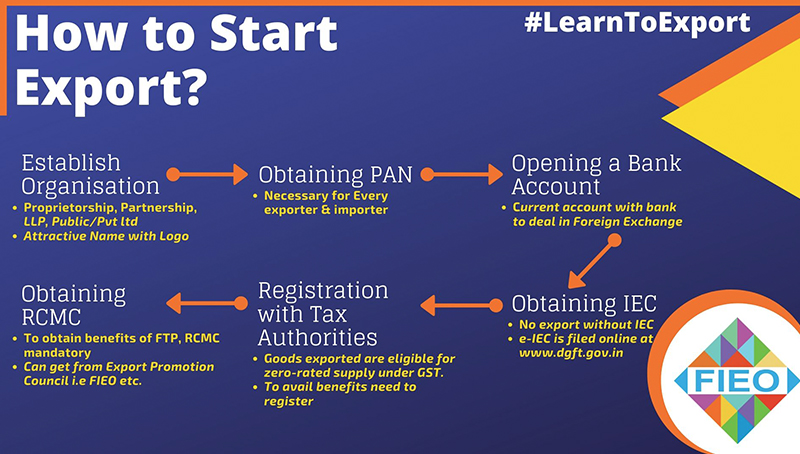

To start an export business, the following steps may be undertaken:

- Establish organisation - Proprietorship, Partnership, Public/Private Limited, LLP. Attractive name with logo is advisable

- Open a bank account - A current account with a bank authorised to deal in foreign exchange should be opened

- Obtain a PAN number - It is necessary for every exporter and importer to obtain a PAN from the Income Tax department.

- Obtain IEC (Import Exporter Code) - As per Para 2.05 of the Foreign Trade Policy, 2015-20 no export can be made without obtaining an Import Exporter Code (IEC) . An application for e- ICE is filed online at www.dgft.gov.in as per ANF 2A with an application fee of INR 500- (Net banking or credit / debit card) and it is PAN based. Document required: Cancelled cheque (With entity's pre-printed name) and address proof of applicant entity.

- Obtain RCMC (Registration Cum Membership Certificate) - To get the benefits of the Free Trade Policy it is mandatory to obtain RCMC from Export Promotion Council/FIEO/boards etc.

- Registration with tax authorities - Goods exported out of the country are eligible for zero-rated GST. To get this benefit, it is important for an exporter to get registered with the concerned tax authorities.

Exportability of products

Exports and Imports shall be free, except in cases where they are regulated by the provisions of this Policy or any other law for the time being in force. The item wise export and import policy shall be, as specified in ITC (Indian Trade Clarification) HS (Harmonised System of coding) published and notified by Director General of Foreign Trade, as amended from time to time, is available at www.dgft.gov.in

The Director General of Foreign Trade may, however, specify through a Public Notice such terms and conditions according to which any goods, not included in the ITC (HS), may be exported without a license/ certificate/ permission.

Schedule 1 of ITC (HS) gives the Import Policy Regime and Schedule 2 of ITC (HS) gives the Export Policy Regime. Schedule 2 categorises products as:

- Free: Products categorised as free can be exported without any permission from DGFT subject to condition, if any mentioned against the product in the ITC (HS) Book and any other law of the country governing their exports

- Restricted: Before exporting any restricted goods, the exporters must first obtain an authorisation explicitly permitting the exporter to do so. The restricted goods must be exported through a set of procedures/conditions, which are detailed in the license.

- Prohibited: These are the items that can not be exported at all. The majority of these include wild animals and animal articles or those prohibited for trading through an international convention.

- State Trading Enterprises (STE) - Certain items can be exported only through designated STEs. The export of such items is subject to the conditions specified in the ITC (HS) Book.

Important aspects while exporting

1. Sampling - Providing customised samples as per the demands of Foreign buyers help in getting export orders. As per FTP 2015-2020, exports of bonafide trade and technical samples of freely exportable items shall be allowed without any limit.

2. Denomination of Exports Contracts - All export contracts and invoices shall be denominated either in freely convertible currency or Indian rupees but the export proceeds shall be realised in freely convertible currency.

3. Pricing/Costing - The price should be worked out taking into consideration all expenses from sampling to realisation of export proceeds on the basis of terms of sale i.e. Free on Board (FOB), Cost, Insurance & Freight (CIF), Cost & Freight(C&F), etc. Goal of establishing export costing should be to sell maximum quantity at competitive price with maximum profit margin.

4. Payment Term - Deciding on the best payment term

5. Customs house agents - Exporters may avail services of Customs House Agents licensed by the Commissioner of Customs. They are professionals and facilitate work connected with clearance of cargo from Customs.

6. Mandatory documents for export of goods from India -

- Bill of Lading/Airway Bill/ Lorry Receipt/ Railway Receipt/Postal Receipt.

- Commercial Invoice Packing List

- Shipping Bill/Bill of Export

(In specific cases of export or import, the regulatory authority concerned may electronically or in writing seek additional documents)

7. Customs procedure - No goods can be exported without clearance of export consignment by customs which issues the Let Export Order after are filing of shipping bill.

8. Submission of export documents to bank - Within 21 days from the date of export, exporter should lodge the copy of EDF together with relative shipping documents and an extra copy of the invoice with the Banks. In cases, where exporters present documents pertaining to exports after the prescribed period of 21 days from date of export, Banks may handle them without prior approval of the Reserve Bank, provided they are satisfied with the reasons for the delay.

9. Mode of payment of export - The amount representing the full export value of the goods exported shall be received through a Bank in the manner specified in the Foreign Exchange Management (Manner of Receipt & Payment) Regulations, 2000 in the following manner:

- Bank draft, pay order, Banker’s or personal cheques.

- Foreign currency notes/foreign currency travellers cheques from the buyer during his visit to India.

- Payment out of funds held in the FCNR/NRE account maintained by the buyer

- International Credit Cards of the buyer.

Note: When payment for goods sold to overseas buyers during their visits is received in this manner, EDF (duplicate) should be released by the Banks only on receipt of funds in their Nostro account or if the Bank concerned is not the Credit Card servicing Bank, on production of a certificate by the exporter from the Credit Card servicing Bank in India to the effect that it has received the equivalent amount in foreign exchange, Banks may also receive payment for exports made out of India by debit to the credit card of an importer where the reimbursement from the card issuing Bank/ organisation will be received in foreign exchange.

10. Realisation of export proceeds - As per FTP 2015-2020, all export contracts and invoices shall be denominated either in freely convertible currency of Indian rupees, but export proceeds should be realised in freely convertible currency except for export to Iran. Export proceeds should be realised in 9 months.

11. SPS/TBT Measures - It covers technical requirements resulting from food safety and animal and plant health measures, including pesticide residue limits, inspection requirements and labeling etc. set by a country.

12. Export Inspection Agencies - They promote manufacturer exporters to implement best quality management system to produce a consistent quality product to meet buyer’s specification and gain confidence of the buyer by pre shipment inspection, quality control and certification with many laboratories countrywide.

13. FTAs/PTAs/MFN - These agreements, which can be bilateral or multilateral, reduce or eliminate trade barriers such as tariffs and quotas which gives price competitiveness as well as lead to creation of new markets for businesses, facilitate the production of high-quality goods and enhance economic growth.

Customs procedures

It is necessary to obtain PAN based Business Identification Number (BIN) from the Customs prior to filing of shipping bill for clearance of export good and open a current account in the designated Bank for crediting of any drawback amount and the same has to be registered on the system.

In case of Non-EDI, the shipping bills or bills of export are required to be filled in the format as prescribed in the Shipping Bill and Bill of Export (Form) regulations, 1991. An exporter need to apply different forms of shipping bill/ bill of export for export of duty free goods, export of dutiable goods and export under drawback etc.

Under EDI System, declarations in prescribed format are to be filed through the Service Centers of Customs. A checklist is generated for verification of data by the exporter/CHA. After verification, the data is submitted to the System by the Service Center operator and the System generates a Shipping Bill Number, which is endorsed on the printed checklist and returned to the exporter/CHA. In most of the cases, a Shipping Bill is processed by the system on the basis of declarations made by the exporters without any human intervention. Where the Appraiser Dock (export) orders for samples to be drawn and tested, the Customs Officer may proceed to draw two samples from the consignment and enter the particulars thereof along with details of the testing agency in the ICES/E system:

- The goods have not yet been allowed "let export" amendments may be permitted by the Assistant Commissioner (Exports).

- Where the "Let Export" order has already been given, amendments may be permitted on by the Additional/Joint Commissioner, Custom House, in charge of export section.

In both the cases, after the permission for amendments has been granted, the Assistant Commissioner / Deputy Commissioner (Export) may approve the amendments on the system on behalf of the Additional /Joint Commissioner. Where the print out of the Shipping Bill has already been generated, the exporter may first surrender all copies of the shipping bill to the Dock Appraiser for cancellation before amendment is approved on the system.

GST procedure

Every exporter, irrespective of his turn-over, is able to be registered with GSTIN in Part A of Form GST REG-01 on the common portal.

Under GST, export of goods and services are treated as zero-rated supply. This zero-rated supply enables the exporter to be entitled to claim refund of GST paid on input. Exporter has two options to claim refund:

- Export under LUT/Bond and claim refund of accumulated input tax credit

- Export on payment of IGST and claim refund thereof.

To explore business opportunities, link with me by clicking on the 'Invite' button on our eBiz Card.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views, official policy or position of GlobalLinker.

Posted by

Federation of Indian Export OrganisationsFIEO is the apex international trade promotion organisation of India. Directly and indirectly it represents the interest of over 200,000 exporters in India. FIEO has 17 offices in...

View Federation of Indian 's profile

Most read this week

Comments

Share this content

Please login or Register to join the discussion