Technology in Retail: It's Really About Adoption

Retail

534 week ago — 14 min read

Instant. Disruptive. Smarter. That's what technology is supposed to be to retail. Be it SMAC (Social, Mobile, Analytics, Cloud) or specific developments such as augmented reality apps, queue-busting solutions, virtual 'endless aisle' displays,drone delivery and beacons, there's no question that the technology options available to retailers in India have never been greater. Therefore, logically, customer experience should have improved manifold – the stated purpose of each of these technology innovations has always been customer centricity.

If that's the case, how come you and I – as consumers – don't quite agree with that conclusion? Availability of technology might be higher than before, but adoption by Indian Retailers is variable.

Market structure

Technology adoption in Indian Retail has not been uniform – in terms of scale or speed. Brick-and-mortar retailers have made the journey through ERP, merchandise management and supply chain systems (an 'inside-out' focus) and are now looking at technology to track and engage customers.

E-tailers have adopted technology through web-based platforms and then worked 'backwards' to integrate technology into their supply chains (an 'outside-in' perspective). The business design of e-commerce is focused on customer facing technology, and most e-tail ventures are owned by technologists, so this approach to technology is not surprising.

The market structure in India suggests that there is a large under-banked segment when it comes to technology. While 6% of the USD 440 bn Indian retail sector is organized (including e-commerce players) and 35% of retailers are the mom-and-pop variety, there is a residual, large mid-segment of emerging retailers. These are single or multi-store retailers, usually in one city, who have adopted aspects of technology (usually billing and inventory) and are increasingly using e-marketplaces to create visibility and reach. They are also toying with the fringes of social media for customer engagement.

Customers are therefore subject to differential experiences, depending on which segment of retailer they are buying from, and where the retailer is in the life-cycle of technology adoption.

“It's the consumer, stupid!”

Most Indian consumers today are digital converts. They have smartphones, but rarely use them to their full potential. They didn't grow up with the high-tech tools now available to them, but adapted to them, often skeptically. Until the digital natives — those who don't know life without the Internet — outweigh the digital converts in the Indian market, brick-and-mortar retailers are going to be wary of investing in and deploying technology that might scare traditional consumers away.

The customer's mental imagery around shopping drives the pace at which the retailer adopts technology .For instance, for the age group of 35 to 60+ outside the metros, shopping is mentally and emotionally connected with high-street imagery. And, as the lower part of the graphic shows, this segment commands about a third of the purchasing power in the market. Similarly, the 25 to 40 segment, which is exposed to malls, will mentally correlate a mall with their shopping experience. However, the reality is that only 47 cities in India have malls. This segment represents much of the 'share of wallet' and they are digital converts, not digital natives.

It's the 15 to 30 age group that is the digital natives. But they do not, as yet, command enough share of wallet to justify large technology investments by brick-and-mortar retailers.

Technology providers need to calibrate their offerings to the Indian market to this reality.

Market evolution

Unlike the US / UK or Europe, the retail market in India is driven by first time consumers, with fast-paced consumption. Indian retail consistently grows at 5% above GDP growth and consumption is still spreading to tier- III, IV, V cities, towns and villages.

In mature markets, technology adoption was driven by the need to differentiate and cannibalise an existing (largely static) customer base. The US / UK / European markets have already seen their 'demographic dividend' or the 'baby boomers' (Gen X) from the 1960s to the 1990s. During that phase of market expansion, the Internet didn't exist, so retailers had the luxury of adopting an 'inside-out' approach to technology with the focus being on large format aggregation and streamlining supply chains. Arguably, these markets were ready for the disruptive power of SMAC — part of the reason why these technology innovations took root in those markets.

In India, the basics — supply chain automation, reliable bandwidth — are still relatively nascent. This means the business complexity is significantly higher, which has automatically forced retailers to an inside-out frame of reference when it comes to technology adoption.

Any analysis of technology adoption in India needs to recognise this difference — for the Indian retailer, the opportunity cost of diverting management attention into technology adoption can be lost market share. This is the reason why the three segments of the Indian retail market — the brick-and-mortar retailers, the e-tailers and the emerging independent retailers — behave differently from each other when it comes to technology and its adoption.

“We can't afford it”

Brick-and-mortar retailers in India bemoan the fact that they cannot raise capital on the same terms as their e-commerce counterparts and so can't spend as much on technology. In the current market context, where capital is available aplenty to proven e-commerce stories, there is some truth to this.

But the more compelling reason for differential rates of technology adoption is about the DNA of the e-commerce start up v/s the brick-and-mortar business. In a small e-commerce venture, technology is a do-or-die play and short time to market is an essential feature for success. It is this survival pressure that drives technology adoption. Companies with larger budgets — and more time — tend to play safe and go for off-the-shelf solution implementations or bought out solutions. These higher investments tend to have higher thresholds of justification and complexity, leading to slower decision making and more oversight being required, neither of which is conducive to innovation. However, these large-budget companies do have more money to put behind proofs of concept and cutting-edge technology, both of which make it easier to innovate.

Market evolution

Unlike the US / UK or Europe, the retail market in India is driven by first time consumers, with fast-paced consumption. Indian retail consistently grows at 5% above GDP growth and consumption is still spreading to tier- III, IV, V cities, towns and villages.

In mature markets, technology adoption was driven by the need to differentiate and cannibalise an existing (largely static) customer base. The US / UK / European markets have already seen their 'demographic dividend' or the 'baby boomers' (Gen X) from the 1960s to the 1990s. During that phase of market expansion, the Internet didn't exist, so retailers had the luxury of adopting an 'inside-out' approach to technology with the focus being on large format aggregation and streamlining supply chains. Arguably, these markets were ready for the disruptive power of SMAC — part of the reason why these technology innovations took root in those markets.

In India, the basics — supply chain automation, reliable bandwidth — are still relatively nascent. This means the business complexity is significantly higher, which has automatically forced retailers to an inside-out frame of reference when it comes to technology adoption.

Any analysis of technology adoption in India needs to recognise this difference — for the Indian retailer, the opportunity cost of diverting management attention into technology adoption can be lost market share. This is the reason why the three segments of the Indian retail market — the brick-and-mortar retailers, the e-tailers and the emerging independent retailers — behave differently from each other when it comes to technology and its adoption.

“We can't afford it”

Brick-and-mortar retailers in India bemoan the fact that they cannot raise capital on the same terms as their e-commerce counterparts and so can't spend as much on technology. In the current market context, where capital is available aplenty to proven e-commerce stories, there is some truth to this.

But the more compelling reason for differential rates of technology adoption is about the DNA of the e-commerce start up v/s the brick-and-mortar business. In a small e-commerce venture, technology is a do-or-die play and short time to market is an essential feature for success. It is this survival pressure that drives technology adoption. Companies with larger budgets — and more time — tend to play safe and go for off-the-shelf solution implementations or bought out solutions. These higher investments tend to have higher thresholds of justification and complexity, leading to slower decision making and more oversight being required, neither of which is conducive to innovation. However, these large-budget companies do have more money to put behind proofs of concept and cutting-edge technology, both of which make it easier to innovate.

“IT's the consumer”

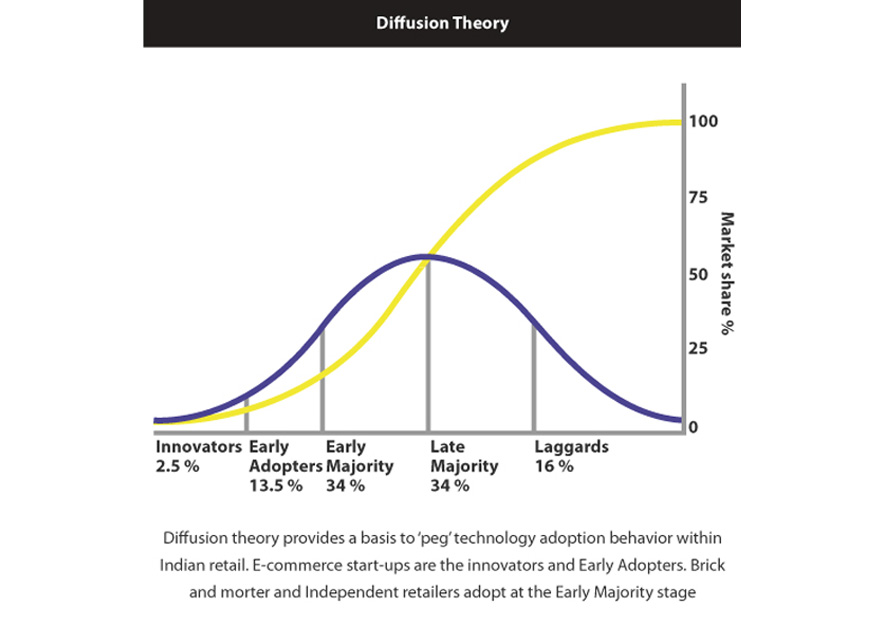

The pace of technology adoption is driven by customer adoption. To quote diffusion theory (see the graphic), Early Adopters among the customer base will dabble with any new technology. But it's when the Early Majority segment (usually representing a third of the target market) adopts, that technological innovation becomes viable at a market level.

In the graph below, the yellow curve shows how market share increases as various segments of consumer adopt to a new or technological innovation. The market tipping point is at 25% market share i.e. when the Early Majority segment starts adopting the technology. This is the phase of exponential market growth i.e. the market share graph rises exponentially. The second tipping point is at 50% market share, the rate of growth slows down as the Late Majority segment adopts.

For the three segments of Indian retailers, technology adoption takes place at different points on the curve. E-tailing start-ups sell to consumers, who are Innovators and Early Adopters. If they are able to convert the Early Majority, then their business 'tips' into the growth phase and they are able to succeed. During this early adoption phase larger brick-and-mortar retailers will take note of the new market development and may start to include it into their technology plans. If this development is also accompanied by a reduction in the cost of adoption of technology, the SME retailers will adopt, thus increasing the pace of growth of market share. For instance, mobile apps have seen adoption by e-tailers. In the last six months, all marketplaces: Flipkart, OLX, Jabong, Quickr, Amazon have launched their mobile apps. Currently, about 12% of all online transactions are through mobile so we are in the Early Adopter phase. As this increases, one can expect brick-and-mortar retailers to adopt.

Balancing innovation with customer expectations

What can retailers do to push consumers to adopt technology? Retailers can help consumers prepare before unleashing new technology. For example, Amazon CEO Jeff Bezos announced the company's plans for an airborne drone-based delivery service in December 2013, even though the service was piloted only in June 2014.

Premature announcements like this create deliberate disruption in the social world and get the buzz going among consumers. The innovators and early adopters among the consumer base are 'primed' to adopt. These kind of premature announcements also help create recall among potential Early Majority consumers, the segment which is the make or break in terms of adoption. Technologists have understood this, which is why Google introduced its Google Glass to a limited group years before its market launch. Closer home, this is also the reason why Home Shop18 created a Shopping Wall In Delhi airport's Terminal 3– the experiment was aimed at creating impact and visibility as a prelude to adoption.

Consumers need time to warm up to disruptive technology before they are willing to adopt en-masse.

There are risks involved; in the sense that the Early Adopter consumer will also have correspondingly high expectations so trying this with something, which is only incrementally innovative is a sure route to failure.

It's as important that retailers take the time to define a route map, which spans at least three to five years and is based on a core premise of catering to a core customer need. Given demographics in India, consumer profile will shift towards those who are digital natives so the technology road map needs to focus on and measure the pace of adoption. For example, the digital native customer expects personalised promotions and offers. This means retailers have to look at how soon they can use technology to think of their customers as 'segments of one'. Given how vocal digital natives are, and the amplification power of social media, introducing a new technology that underestimates its users could be just as dangerous as investing in over-advanced technology today.

Article Source: STOrai Magazine

View STOrai 's profile

Other articles written by STOrai Magazine

The Art & Science of People Pleasing in Retail

11 week ago

Most read this week

Trending

Ecommerce 4 days ago

Comments

Share this content

Please login or Register to join the discussion