Budget impact on direct taxes

Tax & Auditing

268 week ago — 7 min read

Background: In the Union Budget 2020, the Finance Minister introduced several proposals related to direct taxes. Vertika Kedia, co-founder of tax consultancy firm Tax2Win, shares the key highlights of the budget for direct taxes.

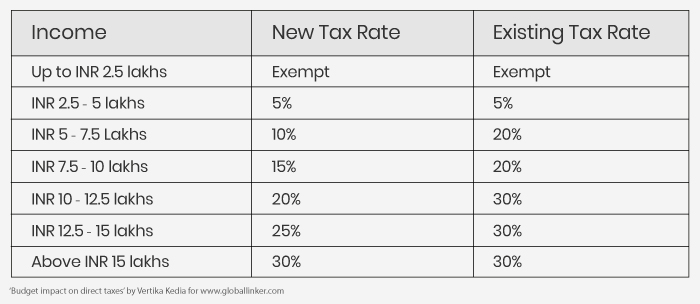

1. New Optional Tax Regime Introduced

As per New Optional Tax Payers Regime a taxpayer can now choose to opt for the new tax slab for FY 2020-21 (AY 2021-22).

There are more than 100 deductions and exemptions available to taxpayers under the Income Tax Act. Under the new tax regime, 70 have already been rolled out and remaining are still under the process of streamlining. None of the chapter VI-A deduction allowed except for 80CCD(2) and 80JJAA if you opt for new and reduced income tax rates. If you go by new slab rates as announced in today's Budget then, you will not be eligible to claim the following tax benefits:

- Leave travel concession as contained in clause (5) of section 10

- House rent allowance as contained in clause (13A) of section 10

- Some of the allowance as contained in clause (14) of section 10

- Standard deduction of INR 50,000 u/s 16

- Employment/professional tax deduction as contained in section 16

- Interest under section 24 in respect of self-occupied or vacant property referred to in sub-section (2) of section 23. (Loss under the head income from house property for rented house shall not be allowed to be set off under any other head and would be allowed to be carried forward as per extant law);

- Any deduction under chapter VI-A; [except 80CCD(2) - NPS Contribution by the employer and 80JJAA] Others as prescribed.

The option shall be exercised for every previous year where the individual or the HUF has no business income, and in other cases the option once exercised for a previous year shall be valid for that previous year and all subsequent years.

2. Dividend Distribution Tax (DDT) scrapped

No Dividend Distribution Tax (DDT) to be paid by Companies from FY 2020-21. Hence the dividend income will become taxable in the hands of taxpayers irrespective of the amount received at applicable income tax slab rates.

3. Section 80G Changes

Presently complete details of donee (the person to whom the donation is made) are required to be entered manually by the taxpayer. To make the process hassle-free it is proposed that donee’s information will be prefilled in the ITR form. Also, the registration process for new charitable institutions will be made completely online.

4. Increased Audit Limit for MSMEs

Budget 2020 increased the tax audit limit to INR 5 crore. For availing the benefit aggregate cash transactions (receipts / payments) in the year shall not exceed 5%.

5. Section 80EEA change

Budget 2020 extended tax benefit for one more year. Now benefit can also be claimed on loan sanctioned till 31st March 2021 (earlier the deadline was 31st March 2020). If you opt for a new tax regime then the benefit of interest on home loan under section 24 on self occupied property, section 80C, section 80EE, and section 80EEA cannot be claimed.

6. Vivvad Se Vikas Scheme introduced

No interest and penalty would be levied if tax payments are done by 31st March 2020. In case payments are done by 30th June some additional amount shall levy.

7. Form 26AS

It contains the details of tax deducted or collected, self assessment tax and advance tax etc during the relevant year. With changes proposed by Budget 2020, Form 26AS will now have details pertaining to sale or purchase of property details and other specified transactions.

8. Section 194J

Budget 2020 proposes to reduce TDS rate in case of fees for technical services (other than professional services) to 2% from the existing 10%. TDS rates in other cases will remain unchanged.

9. Section 80GGA change

No deduction for cash donations exceeding INR 2,000 shall be allowed. If you want to claim tax benefit u/s 80GGA etc then you should opt for the old tax regime.

10. Section 194C

Definition of “work” under section 194C will be modified to provide that in a contract manufacturing, the raw material provided by the assessee or its associate will fall within the purview of the ‘work’ under section 194C. The word Associate is proposed to be defined to mean a person who is placed similarly in relation to the customer as is the person placed in relation to the assessee under the provisions contained in clause (b) of sub-section (2) of section 40A of the Act.

11. Residential status change

- As per the Budget, a citizen of India would be deemed to be a resident in India in any financial year, if he/she is not liable to tax in any other country.

- Number of days reduced in the existing basic condition of residential status to 120 days or more from existing 182 days or more in case a person of Indian Origin comes to India on visit.

- Further, Conditions to be replaced for not ordinarily resident. Now, an Indian resident would be considered as not ordinarily resident if he has been a non-resident in India in 7 out of 10 preceding financial years.

12. Benefits to startups

Following reliefs are offered to startups.

- Now ESOP tax payment can be deferred for 5 years by the startups subject to certain conditions.

- Deduction on profits increased from 7 years to 10 years time period.

- Turnover limit for the exemption for startups now increased to INR 100 crore

13. Reduced taxes for cooperative societies

Cooperative Societies to have a reduced tax rate of 22% + 10% surcharge + 4% cess. Deductions will not be available to the cooperative societies in this case as specified in the law. There will also be no applicability of AMT.

14. Faceless appeals introduced, like faceless assessments.

15. Budget 2020 announced instant PAN allotment on the basis of Aadhaar. No forms to be filled.

16. Concessional rate of tax @15% proposed for the power generation sector undertakings.

17. Tax-payer charter to be made part of statues.

Also read: SMEs evaluate Budget 2020

Image source: shutterstock.com

To explore business opportunities, link with me by clicking on the 'Connect' button on my eBiz Card.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views, official policy or position of GlobalLinker.

View Vertika 's profile

Other articles written by Vertika Kedia

Tax saving tips for small businesses in 2020

272 week ago

Most read this week

Trending

Ecommerce 1 day ago

Comments

Share this content

Please login or Register to join the discussion